Your Chapters of bankruptcy images are ready. Chapters of bankruptcy are a topic that is being searched for and liked by netizens today. You can Download the Chapters of bankruptcy files here. Get all royalty-free photos and vectors.

If you’re searching for chapters of bankruptcy pictures information connected with to the chapters of bankruptcy topic, you have come to the ideal site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

Chapters Of Bankruptcy. Chapter 7 bankruptcy is known as ”liquidation,”while chapter 13 is called “reorganization.”. Bankruptcy petitions were filed nov. Chapter 7 deals with basic liquidation for businesses and individuals. The role of a bankruptcy attorney.

Bankruptcy Law Principles, Policies, and Practice From store.lexisnexis.com

Bankruptcy Law Principles, Policies, and Practice From store.lexisnexis.com

The most common types are chapter 7, chapter 13, and chapter 11. The types of bankruptcy talk about here are chapters 7, 12, 13, 9 and 11. This amount includes the court fee, credit report, and two required online classes. Creditors are prohibited from collecting debts once your bankruptcy case is finalized. Two — chapter 7 and chapter 13 — are variations on the personal bankruptcy theme. It’s arguably the simplest type of bankruptcy and generally accounts for somewhere around two out of every three bankruptcy cases.

Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

As such, the debtor may still be required to make payments on some loans. 883 , which revised the bankruptcy act generally and materially amended the provisions covering corporate reorganizations, repealed by pub. Chapter 7 bankruptcy is one of a handful of available options for those filing for bankruptcy. The bankruptcy act of july 1, 1898, ch. 544, as amended, sometimes called the nelson act, repealed by pub. The main difference is that there is no limit regarding the amount of money owed by the debtor.

Source: avvo.com

Source: avvo.com

Chapter 13 costs and fees. The most common types are chapter 7, chapter 13, and chapter 11. Nonexempt assets could be liquidated by the bankruptcy trustee. Creditors are prohibited from collecting debts once your bankruptcy case is finalized. Chapter 11 cases are by far the most complicated of bankruptcy cases, and as a result, there are very few law firms that handle chapter 11 cases, but many times individuals and companies cannot obtain the relief.

Source: cnbc.com

Source: cnbc.com

Filing for bankruptcy is not to be taken lightly. There are several types of bankruptcy. It’s arguably the simplest type of bankruptcy and generally accounts for somewhere around two out of every three bankruptcy cases. Two — chapter 7 and chapter 13 — are variations on the personal bankruptcy theme. Creditors are prohibited from collecting debts once your bankruptcy case is finalized.

Source: gisondolaw.com

Source: gisondolaw.com

Chapter 12 pertains to rehabilitation for fisherman and farmers. Under title 11, there are six types of bankruptcy. Chapter 7 bankruptcy is one of the cheapest debt relief options. Our fee for the typical chapter 13 bankruptcy is $4,900. Chapter 7 bankruptcy is known as ”liquidation,”while chapter 13 is called “reorganization.”.

Source: store.lexisnexis.com

Source: store.lexisnexis.com

The bankruptcy code contains three additional chapters of bankruptcy: Filing for bankruptcy is not to be taken lightly. 544, as amended, sometimes called the nelson act, repealed by pub. Nonexempt assets could be liquidated by the bankruptcy trustee. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

Source: getoutofdebt.org

Source: getoutofdebt.org

This amount includes the court fee, credit report, and two required online classes. Chapter 11 cases are by far the most complicated of bankruptcy cases, and as a result, there are very few law firms that handle chapter 11 cases, but many times individuals and companies cannot obtain the relief. It forgives most unsecured debts , such as credit card debt, medical bills , and personal loans. Two — chapter 7 and chapter 13 — are variations on the personal bankruptcy theme. Bankruptcy petitions were filed nov.

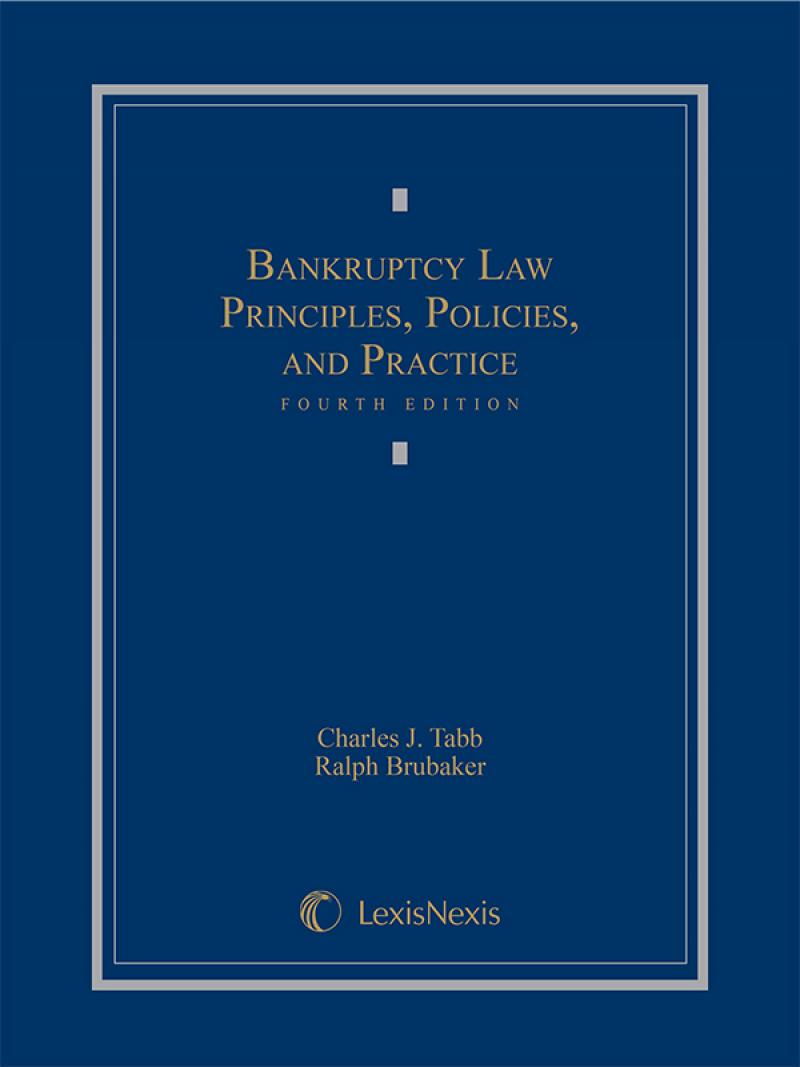

Source: infographiclabs.com

Source: infographiclabs.com

The most common types are chapter 7, chapter 13, and chapter 11. Chapter 7 bankruptcy is one of the cheapest debt relief options. The main difference is that there is no limit regarding the amount of money owed by the debtor. Chapter 7 bankruptcy is one of a handful of available options for those filing for bankruptcy. You may lose your assets if you can’t afford payments.

Source: rare-reads.tk

Source: rare-reads.tk

Business bankruptcies typically fall into one of three categories. Business bankruptcies typically fall into one of three categories. Creditors are prohibited from collecting debts once your bankruptcy case is finalized. The types of bankruptcy talk about here are chapters 7, 12, 13, 9 and 11. The bankruptcy act of july 1, 1898, ch.

Source: turnaround.org

Source: turnaround.org

The bankruptcy act of july 1, 1898, ch. Filing for bankruptcy is not to be taken lightly. The bankruptcy code contains three additional chapters of bankruptcy: As such, the debtor may still be required to make payments on some loans. Those assets of a debtor that are not exempt from creditors are collected and liquidated (reduced to money), and the proceeds are distributed to creditors.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chapters of bankruptcy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.